|

|

|

Australasian Agribusiness Review - Vol. 13 - 2005

Paper 3

ISSN 1442-6951

Extending The Grapevine: Innovation and knowledge tranmission within the Australian wine industry

David Aylward

Faculty of Commerce, University of Wollongong, NSW

Abstract

Innovation and its uptake are two key ingredients in the Australian wine industry’s rapid rise from cottage industry to international success. The industry has a well-deserved reputation of leadership in the funding, coordination and adoption of both product and process innovation. This leadership continues to underpin its competitive advantage in oenological and viticultural practices, training, branding, and export.

Empirical research, however, upon which this paper is based, suggests that this success may be disguising systemic flaws. One of the most threatening of these flaws is the relative lack of access to the industry’s dominant knowledge cluster by the myriad regional firms. The intensity of this cluster and inadequate transmission of knowledge beyond its parameters is undermining the vast majority of Australian wine firms’ ability to participate in the industry’s leading edge research and development. This, in turn, could well threaten the industry’s future leadership.

Introduction and Background

Research into innovation and the transmission of knowledge has increasingly focused on rapidly evolving collaboration within and across a number of industry sectors. Studies of such collaboration have typically employed the application of dominant innovation theories within the manufacturing, IT and electronics industries. They tend to use a national systems of innovation (NSI) approach, emphasising the growth of relationships between government, industry and public sector research organisations, or as some describe it, the triple-helix model (Etzkowitz,, Webster, Gebhardt and Terra, 2000).

Fewer studies have focused on the transmission and adoption of knowledge within agricultural sectors. This industry sector has suffered from an ‘old industry’ reputation. Yet in Australia at least, it boasts the most dynamic growth of all sectors through the bourgeoning wine industry. The Australian wine industry is currently the 6th largest wine producer in the world and 4th largest exporter, creating around $2.3 billion worth of export sales per year with a growth rate of over 30%. The industry adds approximately 200 additional wineries each year and is considered a world leader in development, transmission and adoption of innovation (Winetitles, 2003).

Demonstrating his cluster theory, Michael Porter has drawn specific attention to the Australian wine industry phenomenon (Porter, 2002). In several publications he holds it up as a prime example of how competitive advantage is achieved through the effective collaboration of suppliers, producers, government bodies and research organisations (Porter, 2002). He points out that clusters, of which he says the Australian wine industry is an example, promote both competition and cooperation and that much of the vertical cooperation includes companies in related institutions and local public sector bodies. Porter claims that competition within clusters is also encouraged through the increase of productivity within the cluster, the increased pace and appropriate direction of innovation and the establishment of new businesses, all of which further strengthen the cluster (Porter, 1998)

This ‘competitive advantage’ is reinforced by Marsh and Shaw in their report ‘Australia’s Wine Industry: Collaboration and Learning as Causes of Competitive Success’ (Marsh & Shaw, 2000). Marsh and Shaw argue that high levels of collaboration and commitment to innovation have enabled the Australian wine industry to transform itself from cottage industry to global success. Further, they argue that it now stands as an example to the rest of the New World operators of how innovation and its appropriate adoption can create a truly international industry (Marsh & Shaw, 2000).

Both of the above assessments appear correct. The Australian wine industry has taken astonishing leaps in the development, transmission and adoption of leading edge innovation. Through the Grape & Wine Research Development Corporation (GWRDC) and other industry bodies it has coordinated the funding and implementation of this innovation in a remarkably effective way. The industry’s preparedness for innovation uptake and the articulation of that innovation into export oriented opportunities has helped seal Australia’s position as a leader in the internationalisation of the wine industry (Harcourt, T, 2003). The author’s own previous studies substantiate these claims (Aylward 2002, Aylward & Turpin 2003). However, it appears that:

- Porter, Marsh and a number of other contemporary analysts have not identified the potential danger that lies within success.

- They have also failed to discriminate in their analysis of the industry. Porter refers broadly to an ‘Australian wine cluster’. This paper will demonstrate that the term ‘Australian wine cluster’ is indeed misleading.

These two issues are intimately related. First, the label of ‘Australian wine cluster’ fails to discriminate between the myriad wine regions and firms, the vast majority of which lie on the periphery both in terms of industry activity and in geographical connection to the dominant wine cluster. The author will attempt to show that there is in fact one dominant cluster within the industry, the South Australian (SA) wine cluster (Aylward, 2002, 2003). This cluster accounts for approximately 25% of the nation’s firms, but vastly more in terms of production, resources, research services, export intensity and innovation uptake (Winetitles, 2003). There are a number of ‘sub-clusters’ in NSW, Victoria and Western Australia. They are, however, a mere shadow of the SA cluster, lacking the research infrastructure, training capacity, public sector collaboration and institutional drive that are so evident in South Australia (Aylward, 2002, Aylward & Turpin, 2003).

Second, in regards to Porter and March’s failure to identify the potential danger within success, there is growing evidence that the SA wine cluster has intensified to such a degree that it appears to be exerting a ‘gravitational pull’ on R&D services, innovation opportunities and transmission of knowledge. A survey on firm perceptions, detailed in this paper demonstrates this growing trend. Its findings indicate that this ‘gravitational pull’ is resulting in the creation of an R&D ‘epicentre’ linked with export clusters, that may be depriving regional firms of opportunity and access to the same R&D services, training and innovation uptake that those within the ‘epicentre’ enjoy. In addition, the intensity of the cluster is such that transmission of knowledge appears intermittent at best.

This paper, therefore, attempts to go beyond Porter’s and Shaw’s analysis. It provides a snap-shot of current knowledge transmission, together with R&D extension and training programs. Then, drawing on end-user (wine firm) perceptions and a recent survey of export clusters, it attempts to evaluate their effectiveness (Aylward, 2003). The conclusion is that while Australia appears to lead the world in wine innovation uptake and export growth, the uptake of that innovation, the transmission of knowledge and its articulation to export performance is highly centralised. Extension programs are in place, but need to be dramatically enhanced and made regionally focused, and research and training specific if the health of the industry and quality of its produce are to be maintained.

Current Status of Wine Production

There are approximately 1625 wine operators in Australia who produced 1.174 billion litres in 2002 (Wine Online, March 2003). Of these, close to 90% are boutique or small firms. These range from a husband/wife team crushing less than 50 tonnes a year, to established private firms with 10-20 employees, crushing up to 1000 tonnes annually (Australian Wine Online 2001). Distribution by state is shown in Table 1.

A significant majority of these operators are both grape growers and wine makers, a changing trend from 20 years ago, when they were usually one or the other (mostly grower) (Beeston, 2000). The most noticeable trend, however, is the rapidly increasing export orientation of the industry. Export is no longer reserved for the larger, well established companies. Even the smallest boutique wineries are now actively pursuing the export market.

Table 1 Australian Wine Production 2003

State |

Percentage |

New South Wales |

25.35 |

South Australia |

24.80 |

Victoria |

24.72 |

Western Australia |

16.05 |

Tasmania |

5.56 |

Queensland |

3.49 |

Source: Australian Wine Online 2003

Exports

As of December 2002, exports accounted for 471.4 million litres, or $2.3 billion. This represented a volume rise of 30.2% over 2001. (Australian & New Zealand Wine Industry Directory, 2003). The three largest markets, UK, USA and NZ account for around 77% of all exports (volume), with the UK alone consuming 46%. In 2003, approximately 53% of wine firms in Australia were registered as exporters.

Table 2 Percentage of Surveyed Wineries Exporting

South Australia |

75.0% |

Western Australia |

46.0% |

Victoria |

42.4% |

New South Wales |

36.9% |

Tasmania |

25.7% |

Queensland |

9.1% |

An argument being subscribed to by an increasing number of analysts and innovation theorists is that there is a direct association between export activity and higher levels of innovation (Anderson, 2000, p. 34) & (Roper & Love, 2001). The Australian Trade Commission’s Chief Economist, Tim Harcourt encapsulates this idea most clearly:

Exports and Innovation are linked. Innovative firms are the ones that are typically exporting…By choosing to be exposed to the world market those same firms are taking advantage of innovation overseas and bringing it back to Australia. Therefore innovation creates exports, which in turn assists innovation.

We can see from the figures above that the intensity of exporting firms in South Australia is significantly greater than for any other state. Such figures demonstrate the close association between the dominant innovation cluster and high levels of export activity. Wine firms outside this cluster lack the opportunity to participate in innovation and training programs. Such disadvantage has indirect but strong association with an ability to establish and sustain high levels of export activity (Aylward, 2003). To provide a graphic example we can compare two very high profile regions. Both regions have an approximate 150-year history of excellent wine making and awards. Both have high levels of tourism, and are home to many boutique, small and medium sized firms, as well as several large, publicly listed firms. One region is the Clare Valley, located at the very heart of the South Australian ‘epicentre’. Apart from the University of Adelaide and the Cooperative Research Centre for Viticulture (CRCV), Clare valley firms have immediate geographic access to the industry’s leading research body, also located in South Australia, as well as the GWRDC, the Australian Wine Export Council and the vast majority of other industry-related bodies. Approximately 83% of wine firms in the Clare Valley are exporters. The other region is the Hunter Valley in NSW. In stark comparison, the Hunter has a commonwealth university located on its doorstep that in no way services the industry. There is no viticulture or oenology curriculum. The only provision for industry training is a local technical college. There is no R&D carried out for the industry. Interestingly, only 44.5% of Hunter Valley wine firms export (Aylward, 2003).

The Regional Export Paradox

Among the smaller, regional exporters are a large number who are what Saimee, Walters, et al in their article ‘Exporting as an innovative behaviour’ describe as ‘externals’. These are firms whose export activity is intimately linked to government-sponsored programs, export advice, and affordable and timely information, that is, an ability to access the industry’s knowledge flows (Saimee, Walters, DuBois, 1993). As stressed by the Winemakers federation of Australia in its submission to the review of Export Market Development Grants (EMDG): "…small producers face an uphill battle to place their product on the export market.” However, these small wineries are important to the image and reputation of the Australian wine category offshore, because they provide a considerable proportion of the icon and super premium wines that …contribute to the overall quality image of Australian wine” (Winemakers Federation of Australia, 2000).

Therefore, we must ask whether the national investment in research is serving to benefit this growing number of small and specialised, but apparently disadvantaged exporters? Although this category of exporter (who are also the small producers) holds a vital key to the internationalisation of our wine industry, their apparent inability to access appropriate advice, extension programs and key industry bodies could threaten the success of the industry as a whole.

Brief Overview of R&D

Research & Development is seen as a key element in the Australian wine industry’s success. Australia still only accounts for about 3% of the world’s wine production. Its dramatic rise, however, from a position of mediocrity throughout the 1970s and early 80s to perhaps the world’s leading producer and exporter in terms of quality, consistency and value for money, results in significant part from this leading-edge R&D. The industry’s innovative approach to mechanical harvesting, pruning, night picking, better controls over processing and fermentation, together with oenological breakthroughs, soil analysis, pest control and process innovation has created a distinct ‘gap’ in quality between this and traditional approaches adopted by many ‘Old World’ producers (Aylward & Turpin, 2003).

The Australian wine industry, however, is now largely characterised by small firms who either fail to access R&D or, because results are not always commercially viable, are unable to undertake R&D on an individual basis. Such R&D is only carried out by qualified and endorsed scientists, staff and institutions, almost all of whom are based in the South Australian ‘epicentre’. The Australian Wine Research Institute and the University of Adelaide carry out the vast majority of this R&D and are contracted through the GWRDC. It appears that this situation is feeding a ‘cultural gap’ in R&D knowledge. It is the structure of future collaboration and the mechanisms employed that have the potential to address this problem, as outlined in the paper.

Funding for the industry's R&D is derived from the following sources: industry levies collected from the grape and wine producers on tonnes crushed; government funding provided through matching grants; and government funding for project grants. The division of this expenditure is: 48% by the Commonwealth (including GWRDC); 28% by industry; and 24% by State government.

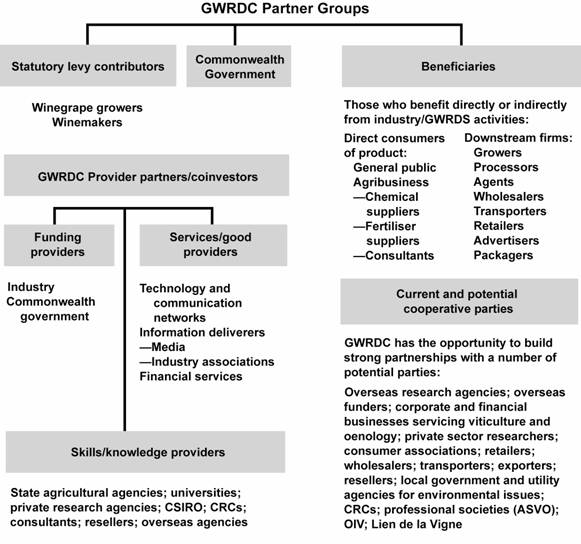

It is primarily in this industry sponsored R&D that links with public sector institutions has been developed. This is achieved through collaborative structures bringing together experts in oenology, viticulture, compliance, residue monitoring, interpretation and strategic planning. (See Figure 1)

Figure 1

Source: GWRDC

Methodology and Survey Firm Characteristics

This paper is based partly on a study carried out in 2001. As part of that study a national survey questionnaire was distributed to wine firms within four selected regions. The aim of the survey was to profile the industry's R&D, training and knowledge transmission as perceived by regional firms.

Nationally, there were 41 firms surveyed/interviewed. Thirty-two of these were sole proprietor/partnerships, 5 subsidiaries of larger companies and 4 were publicly listed companies. The majority had less than 10 employees, 6 had more than 100 employees and 2 had more than 1,000 employees. In terms of annual crush, about a quarter crushed less than 50 tonnes, another quarter crushed between 50 and 200 tonnes, while at the other end of the scale, 4 crushed between 20,000 and 50,000, 3 crushed between 50,000 and 250,000 tonnes.

Approximately 75% of surveyed firms exported their product. The remaining 25% expected to within the next three years. As a percentage of their annual turnover, a quarter of respondents claimed that exports accounted for more than 50%, and more than half claimed that export value had risen as a percentage over the past three years.

The study involved:

- A literature review to establish parameters of inquiry. A survey instrument was then developed and delivered to 41 industry respondents. These respondents were selected to provide a broad cross-section of geographic regions, various levels of industry concentration and firm size. The regions included Mudgee, Hunter, Shoalhaven and the Canberra district. These results fed into the qualitative aspect of the study.

- Field interviews were also carried out with participants in the above regions, focusing on small, medium and large firms.

The study focussed on potential 'users of research', (‘R&D pull’ approach) rather than the research institutions within the industry. It was restricted to these participants because as end users of the R&D, it was felt that their perspective provided the greatest insight in determining the extent to which knowledge and training were being transmitted within the industry.

The four selected regions are quite distinct, each with their unique characteristics influenced by climate, geographic position, tourism and their mix of wine firms. All are significant wine regions, yet do not enjoy strong links to the South Australian ‘epicentre’. This may seem surprising given the reputation of regions such as the Hunter, but the study will show that concentration of R&D resources in the wine industry is intense.

Survey Findings

Levels of Knowledge Concerning Industry R&D

Australian wine production is highly concentrated among large firms within the South Australian ‘epicentre’. There are, however, another 1620 smaller firms or so throughout the country, a number that is growing rapidly. The crucial question of this study is: how effectively is new knowledge penetrating these producers?

The findings from this study confirm concerns raised by the Committee of Inquiry into the Wine Industry (GWRDC) back in 1995, that transmission of R&D being carried out within the industry may be uneven and restricted largely to the SA cluster. As expected, knowledge of and participation in industry R&D activities are largely dependent upon what Porter refers to as viable clusters (Porter, 1998). What Porter does not investigate, however, is the phenomenon of a cluster becoming so intense, with the attraction of resources and knowledge so great, that regional firms may be deprived of those same input ingredients.

Two thirds of surveyed respondents claimed awareness of industry R&D. However, at least 12 were larger firms. They were either public, large private companies or regional subsidiaries of public companies. In the case of the subsidiaries, they have the advantage of stronger links to the 'epicentre' through their parent companies. Only around half the small to medium firms claimed to be aware of industry R&D.

Of the 12 larger firms, at least 10 had high levels of awareness concerning industry R&D, although a number still claimed to be operating on the periphery of R&D decisions taking place in Adelaide. They claimed that while they were involved in innovative activities and utilized industry bodies regularly, they were rarely included in the industry's R&D decision-making processes.

Each study found that there was a strong association between geographic location, firm size and knowledge of industry R&D. In other words, there was a strong and somewhat confined ‘coalition of interests’.

Perceived R&D Benefits

The survey then asked firms if they could identify either direct or indirect benefits from industry R&D. Less than half of the respondents claimed that they had benefited directly from industry R&D, and only five small firms claimed to have done so. Those benefiting directly and regularly from industry R&D were predominantly the larger firms with greater access to the ‘epicentre’. In terms of R&D extension programs (RD&E) the majority of respondents (22 of 37) claimed that programs were either poor and intermittent or needed improvement. Again, this perception reflects the fact that although RD&E programs have been put in place by the GWRDC, they are not attracting the appropriate priority. The GWRDC has attempted to address the concerns raised in the 1995 review by establishing more RD&E programs. However, according to the end-users, such programs do not distinguish between region, type of research, or size of firm. Furthermore they do not link effectively with training requirements of regional areas. Until priority can be given to ‘tailored extension programs perceptions will remain negative.

Exporter Responses: The above findings are supported indirectly in two separate studies, one current and the other part of an Australian Research Council grant, where wine exporters were questioned about their access to R&D and the value they placed on that access. The first study focused exclusively on regional exporters from all industry sectors but from which a significant number of wine firms were extracted. Although at higher levels than other industry sectors, less than half of the regional exporters accessed the industry’s R&D services, with only around 20% accessing it on a regular basis.

The second study focuses exclusively on wine exporters and non-exporters from the SA cluster. In contrast, approximately 60% of exporters within this cluster regularly access the industry’s R&D services. Moreover, access has increased over the past year compared to the last three years (Hodgkinson, Iredale, McPhee, Vipraio, Aylward, 2002 & Aylward, 2003)

Research Funding and Barriers to Knowledge Transmission

In addition to matching government funding the Wine Industry's R&D is funded through a levy which is paid by firms on tonnage crushed and volume of wine.

We asked respondents to the study whether they believed the industry’s R&D levy provided value for money. Although all firms pay this levy ($5 per tonne) consistent with their production, it is obvious that the large firms contribute more in absolute terms. It could therefore be argued that they should be the major beneficiaries of the Industry’s R&D. The majority of respondents argued, however, that the health of the wine industry depended upon a diversified, broad base, fostering quality of product, fruit experimentation, niche marketing and risk taking. Their view was that industry R&D should cater to this base by providing critical assistance at the regional and boutique/small firm level through specific, regionally oriented RD&E programs. Almost half the respondents believed that they were not receiving value for money with the R&D levy. The majority of these respondents were again, the smaller firms.

Many of the smaller firms had very limited R&D skills, industry training or exporting knowledge. They were simply unaware of available opportunities, which inherently limited their access to industry sponsored R&D, extension programs and export advisory services. In response, they continue to argue for an alternative structure that would allow peripheral regions and firms to benefit from new knowledge, innovation and training. Rather than smaller firms benefiting indirectly and sporadically from a ‘trickle-down’ or ‘seepage’ effect as is currently the case, their alternative structure would allow for direct transmission of knowledge via regional winemaking associations with the firms direct interests at heart.

While the surveyed firms tended to place responsibility for lack of adequate R&D service on the industry, this study finds that the issue is more complex. Yes, it appears that the SA wine cluster does impede the value-added transmission of knowledge beyond its parameters, purely as the result of its intensity – and its own success. There are, however, other barriers that are historically complex in nature.

Other identified barriers included:

Innovative Inertia: It became evident from interviews that part of the responsibility for these breaks in knowledge flows also rests with the firms. There was evidence of what we call 'innovative inertia', particularly amongst the boutique and smaller firms. Inertia has been well documented in other industry sectors. It is an umbrella term referring to characteristics such as cost factors, knowledge, preparedness to innovate and the following identified issues (Pol, 1999):

Lack of Research Culture: The fact that small firms viewed innovative activities as 'extra-curricula' illustrates a facet of the 'innovative inertia' that retards the development of a true research culture. A significant number of respondents admitted that they had made little serious attempt to raise their awareness of industry R&D opportunities.

Business Priorities: A number of this group also responded that they would not follow up R&D opportunities unless approached by a collaborator who was prepared to take responsibility for the collaboration. Their business’ short-term outlook was the main priority. Innovation and training and their longer term implications were peripheral concerns.

Limited Expertise: Another was the group’s relative inexperience and unfamiliarity with the research and education side of the industry. Some firms felt uncomfortable dealing in an area in which they had little expertise. It would appear that this perceived lack of expertise is a further inhibiting factor in fostering an adaptive research culture.

From Transmission Barriers to Export Barriers

Just as knowledge transmission translates effectively into export performance within industry clusters, barriers to knowledge transmission also appear to translate into export barriers. This is apparent on two levels (Aylward, 2003). At the first level, we see that larger firms are more likely to have access to knowledge and training opportunities than their smaller counterparts. Additionally, this access is more likely to translate into export opportunity and performance more effectively than with smaller firms. We can look to a wine export mapping study carried out by the author early in 2003 which included 1258 Australian wine firms (Aylward, 2003). We see that nationally, while only 17.2% of micro firms exported, 83.3% of medium sized firms exported and an extraordinary 93% of large firms exported (Aylward, 2003).

On a second level, however, when focusing on particular states we see distinct patterns emerge around the ‘epicentre’, and regionally. For example, while only 17.2% of micro firms export nationally, 42.1% of micro firms around the South Australian ‘epicentre’ export. These include the regions of Eden Valley, the Barossa Valley, Clare Valley and Coonawarra. On the other hand, only 11.8% of micro firms in NSW export and a mere 4.1% in Western Australia. This is despite the fact that both these states host a significant number of high profile wine regions, including the Hunter Valley, Mudgee and Margaret River (Aylward, 2003). As we move up in firm size, the pattern moderates (as expected due to larger firms having greater access to opportunities) but still holds. For example, for those firms processing 250 tonnes a year over 80% of exporters are from South Australia as opposed to 50% from Victoria, 47% from Tasmania and 42% from NSW. It is no coincidence that there is a close overlap of innovation and export intensity maps.

Regional Firms - Importance to Industry

In attempting to further understand the ‘apparent’ paradox of small firm opportunity and productivity, survey respondents were asked to comment on the importance of boutique/small firms to the future of the Australian wine industry. A quarter of the respondents claimed that boutique/small firms were critical to the future of the industry. Approximately half noted that they were important. Only 6 respondents claimed they were either not very important or irrelevant.

As expected, boutique/small firms claimed they play a vital role in the industry's development and diversity. First, is their perceived ability to operate outside the traditional wine making parameters which restrict larger companies with established markets and customers. Theirs is the role of breaking new ground (in terms of product), experimenting in an industry where they believe wine making and product range is in danger of over-standardization. Smaller firms don’t cater to a mass market, have more flexible product lines and few quotas to meet. Therefore, they have the luxury of product experimentation and variation. In short, they are the ones who take the risk. This, they argue, enables the industry to remain flexible, responsive and innovative. A second perception is that a healthy wine industry requires more than a robust export market. It requires a diversified domestic base to accommodate a variety of products, viticultural techniques, markets and future strategies. Small firms argue that without their input the export drive would eventually falter, unable to meet growing demands for variety, quality and complexity. Matching RD&E, therefore, to regional specific requirements such as soil and pest type, niche branding; small firm training requirements and export market analysis was essential to their ongoing vigour.

This paradox is interesting. On the one hand small firms see themselves at the leading edge of the industry in terms of product innovation and experimentation. Yet on the other hand, they also perceive themselves as peripheral to where new knowledge and training are taking place. The training aspect of this paradox is discussed in the following section.

Industry Training

The Australian wine industry, together with that of California, could claim to lead the global wine community in terms of training. Prestigious institutions such as Roseworthy, the University of Adelaide and, more recently, Charles Sturt University have consistently turned out graduates of the highest calibre in oenology, viticulture, management, marketing and other related disciplines. Such training continues to ensure that industry personnel remain at the forefront of product and process innovation. In fact, training has been an integral component in the rapid evolution of the industry from cottage industry status to a global ‘player’. It is also what increasingly sets New World operators such as Australia and California apart from their more traditional Old World rivals.

Australia’s reputation for training excellence is demonstrated continually by the international demand for our graduates and the relatively new phenomenon of the ‘Flying Winemaker’ working on contract in many of the Old World regions of Europe. Industry participants of course recognise the vital role of training. For example, when asked to rank the importance of training to firms personally, survey respondents answered overwhelmingly that it was either critical or important. Of those who claimed it was not very important 5 of the 6 were sole operators, with no employees and no real ambition to expand their operations. In a recent Innovation Survey, these would be described as non-innovators (ABS, 1998)

When we examined actual training usage in regional areas, however, the story was different. A majority (24) of the 37 respondents claimed that they had not as yet made any use of industry sponsored training schemes. Reasons for non-usage included:

- Awareness: A lack of awareness about what was available was a common finding. This was due to the lack of ‘connection’ between regional firms and the research/training hubs of the industry.

- Cost: Among smaller operators, employee numbers, affordability and time away from work accounted for a large percentage of answers. Some operations simply consisted of a husband and wife team. For others, replacement cost of employees while in training featured strongly.

- Alternatives: Among larger firms, the few who claimed not to use training schemes claimed that in-house training was equivalent if not superior in standard. They argued that their training provided practical on-the-job skills suited to their particular company.

The fact is that while the Australian wine industry is a world leader in training, this training, as with other elements of R&D, is highly concentrated. With the exception of Charles Sturt University, located in Wagga, NSW, the vast majority of training is carried out within the industry’s R&D ‘epicentre’ or in areas with direct connections to this ‘epicentre’. Even major wine regions outside the epicentre, such as the Hunter Valley, Mudgee, Margaret River, Yarra Valley and Rutherglen are dependent upon distance education and local technical colleges without ‘connections’ to the ‘epicentre’. Training extension programs are always on the industry agenda. As yet, however, little progress has been made to run these extension programs through the vital regional winemakers’ associations located within each major region. Only through this mechanism, coupled with the establishment of appropriate curricula in regional universities can the industry’s training requirements be diffused effectively at the regional and smaller firm level.

To emphasise the point, these regional data can be compared on a preliminary basis to the author’s current (and ongoing) study into innovation levels and export activity within the SA wine cluster. In answer to the question of how critical training was to the industry, the unanimous response was that it was an essential element of Australia’s R&D leadership. However, unlike the regional respondents, early indicators show that firms within the SA cluster, or ‘epicentre’ put their beliefs into practice. Of the 29 respondents to date, 26, or 90%, strongly encourage the training of their employees. Further, of those trained employees, 21, or 80% had tertiary qualifications. Only three respondents did not have trained employees. Each of these three was a micro husband-and-wife team.

Public sector collaboration

Just less than 50% of respondents have been, or are currently, collaborating with public sector bodies and the majority intend to collaborate in the future. Most still believe that collaborative links are limited at the regional level. Of those who responded to this issue, two-thirds said collaborative activity within their region is low.

These perceptions appear to indicate that although a high degree of collaboration is taking place within the industry, it is a relatively new phenomenon for the majority of firms. Collaboration with public sector bodies is still some way from becoming entrenched within the industry psyche. Secondly, as indicated by two separate studies (Aylward, 2002 & 2003), this collaboration tends to be concentrated. Along with innovation, knowledge transmission, training and export intensity, the industry’s public sector collaboration has evolved at a rapid rate. It has also evolved primarily within highly defined geographic parameters. Collaboration is taking place at regional levels but not to the extent that it is within the industry’s dominant cluster. Again, from the author’s ongoing study into innovation and export within the SA wine cluster, public sector collaboration within this cluster appears intense. Of the 29 respondents so far, 22 or 76% have collaborated with public sector bodies on a regular basis over the past three years. Participation rates are significantly up on regional counterparts but even more telling is the regularity of that participation. Regional collaboration appears to be somewhat sporadic and reactive (Hodgkinson, et al 2003). But as preliminary data show, firms within the SA cluster appear to be embracing a culture of collaboration.

Porter eloquently describes the phenomenon. The close interrelation between firms, suppliers, universities, research agencies, advisory bodies, training providers and government organisations provide a unique (cluster) environment in which collaboration at all levels will flourish (Porter, 1998). The concern is that, with all aspects of innovation and its transmission, collaboration in the Australian wine industry is at risk of the ‘epicentre’s’ ‘gravitational pull’. While the intensity of this ‘epicentre’ is increasing and with that, attracting more collaborators, mechanisms for extending this collaboration to other states and regions are simply not in place. Regional winemakers associations are probably the most effective vehicle for structuring and brokering alliances between firms and public sector bodies. Until very recently, however, these associations have had little power or funding and even now lack the infrastructure, resources and personnel to realise their full potential.

The Way Forward

The great challenge now for the GWRDC and the industry in general, is to work with firms to extend the transmission of R&D/training through flexible mechanisms to those regions outside the SA wine cluster, or ‘epicentre’. This is not an agenda that should originate from the GWRDC alone. It should be one in which there is extensive consultation with each region’s winemakers’ association and regional stakeholders, including technical colleges, regional universities, training providers and the wine firms themselves. It is an agenda that must not reflect the research and training priorities of those firms within the dominant wine cluster as is now the case. Instead, it must be regional-specific, reflecting regional research and training needs, with mechanisms for articulation through to export advisory bodies and activities.

This need is certainly reinforced by the firms themselves, who overwhelmingly support the idea of linking R&D to training and export advise at the regional level. Of the 30 responses to this issue, a significant majority stressed that R&D initiatives should be linked to a range of training instruments by enabling regional associations, together with colleges and universities, to act as training nodes for the identified R&D institutions. This would ensure that the latest thinking on R&D is embraced within the curricular of these regional education bodies and applied to regional priorities.

Regional TAFE colleges, universities and industry training programs, if linked effectively, could thus act as a 'trigger point' for greater interaction between local innovators, exporters and core R&D institutions. The absence of this to date is the weak link that has been identified throughout the study. Linking regional training institutions and export advisory bodies into core R&D activity could act as a catalyst, creating more seamless knowledge flows between industry bodies within the dominant cluster and regional firms. To succeed over the next decade, the Australian wine industry must ensure that its leading edge innovation is transmitted through program, firm and regional specific mechanisms.

Conclusion

Innovation and training efforts within the Australian wine industry have been critical to the sector's international business development, and have reinforced its image as a world leader in innovation. The industry is virtually without peer in its ability to create an ‘innovation vision’ and then fund and coordinate research and development to match that vision. Its 2025 Plan was revolutionary in terms of industry imagination and planning. In fact, many other Australian industry sectors are now using it as a template. The fact that the vast majority of the plan’s milestones are being met significantly ahead of time is a demonstration of how well industry stakeholders have rallied behind that plan. To say that it has been a triumph is not overstating the situation.

But the success has masked some inherent weaknesses in organisational structure. The main weaknesses that this paper has dealt with are:

- The lack of compensatory transmission mechanisms for dealing with the ‘gravitational pull’ of the industry’s dominant cluster.

- Innovative inertia resulting from inadequate R&D extension programs at the regional and small firm level.

- Inadequate mechanisms for linking innovation and training at the regional level to core institutions and knowledge development.

- A lack of regional specific structures for linking innovation needs to export requirements and marketing.

The study identifies an interesting paradox. Many smaller regional firms consider themselves to be at the leading edge of product innovation and experimentation. They see themselves as 'frontier' operators, able to develop niche brands while not being restricted by the standardisation and market demands of the larger firms.

Yet these same firms also see themselves at the periphery of R&D activity within the industry. In large part, they are unable to access effectively the innovative milieu that those within the SA wine cluster, or ‘epicentre’, inhabit. They believe the intensity of the SA cluster together with an absence of alternative innovation and training extension programs and export advice have severely restricted regional opportunities.

So while the Australian wine industry continues to enjoy, justifiably, a world-leading reputation, magnifying the picture serves to highlight some threatening anomalies. These anomalies require immediate and ongoing attention in order to avoid the fragmentation and dislocation evident in many of the industry’s international competitors.

Bibliography

ABS (1998), Innovation in Manufacturing, Australia, Canberra: AGPS

Anderson, K. (2000), Export-led Growth: Lessons from Australia’s Wine Industry, RIRDC.

Australian Wine Online (2001), Web Site, http://www.winetitles.com.au/awol/

Aylward, D. (2003), 'A Documentary of Innovation Support among New World Wine Industries', Journal of Wine Research, 14 (1), 31-43.

Aylward, D. (2003), 'Mapping Australia’s wine exporters', Wine Industry Journal, 18 (5), 68-72.

Aylward, D & Turpin, T. (2003), 'New Wine in Old Bottles: A Case Study of Innovation Territories in New World Wine Production', International Journal of Innovation Management, 7 (4), 501-525

Aylward, D. (2002), 'Diffusion of R&D within the Australian Wine Industry', Prometheus, 20 (4), 351-366.

Beeston, J. A Concise History of Australian Wine, 3rd edition, 2001, Allen & Unwin, UK

Committee of Inquiry into the Winegrape and Wine Industry, Winegrape and Wine Industry in Australia, 1995, AGPS, Canberra.

Etzkowitz, H., Webster, A., Gebhardt, C. & Terra, B.R.C. (2000) “The future of the university and the university of the future: evolution of ivory tower to entrepreneurial paradigm” Research Policy, 29, 311-330

Grape and Wine Research and Development Corporation (GWRDC), Annual Operation Plan 1999/2000

Harcourt, T. (2003) Why Exporters are Good for Innovation, Austrade, Australian Trade Commission Address, Sydney

Hodgkinson, A., Iredale, R., McPhee, P., Vipraio, P. & Aylward, D. (2003) Internationalisation, Information Flows and Networking in Rural and Regional Firms, Final Report and Policy Recommendations, ARC, University of Wollongong Press

Marsh, I & Shaw, B. (2000) Australia’s Wine Industry: Collaboration and Learning as Causes of Competitive Success, Industry Report, 4-10

Mohanak, K., Aylward, D., Garrett-Jones, S., & Turpin, T. (2001) “Regional Innovation: Experiences of Smaller Firms in Non-Metropolitan Australia”, R&D Management Conference, Conference Proceedings, Wellington, NZ

Pol, E., Crinnion, P., & Turpin, T. (1999) Innovation Barriers in Australia: What the Available Data Say and Do Not Say, IBRI Working Paper No.3

Porter, M. (2002) Australian Competitiveness, (Presentation) IIR Leading Minds Conference, Sydney

Porter, M. (1998) “Clusters and the new economics of competition”, Harvard Business Review, 76 (6), 77-90

Roper, S & Love, JH. (2001) “Innovation and Export Performance: evidence from the UK and German manufacturing plants”, Research Policy, 31, 1087-1102

Saimee, S., Walters, P., & DuBois, F. (1993) “Exporting as an innovative behaviour: An empirical investigation”, International Marketing, 10 (3), 5, 21

Winemakers Federation of Australia, (2000) Submission to the Review of the EMDG Scheme

Winetitles, (2003) The Australian and New Zealand Wine Industry Directory, 2003, Winetitles.

|